ccomggame.online Gainers & Losers

Gainers & Losers

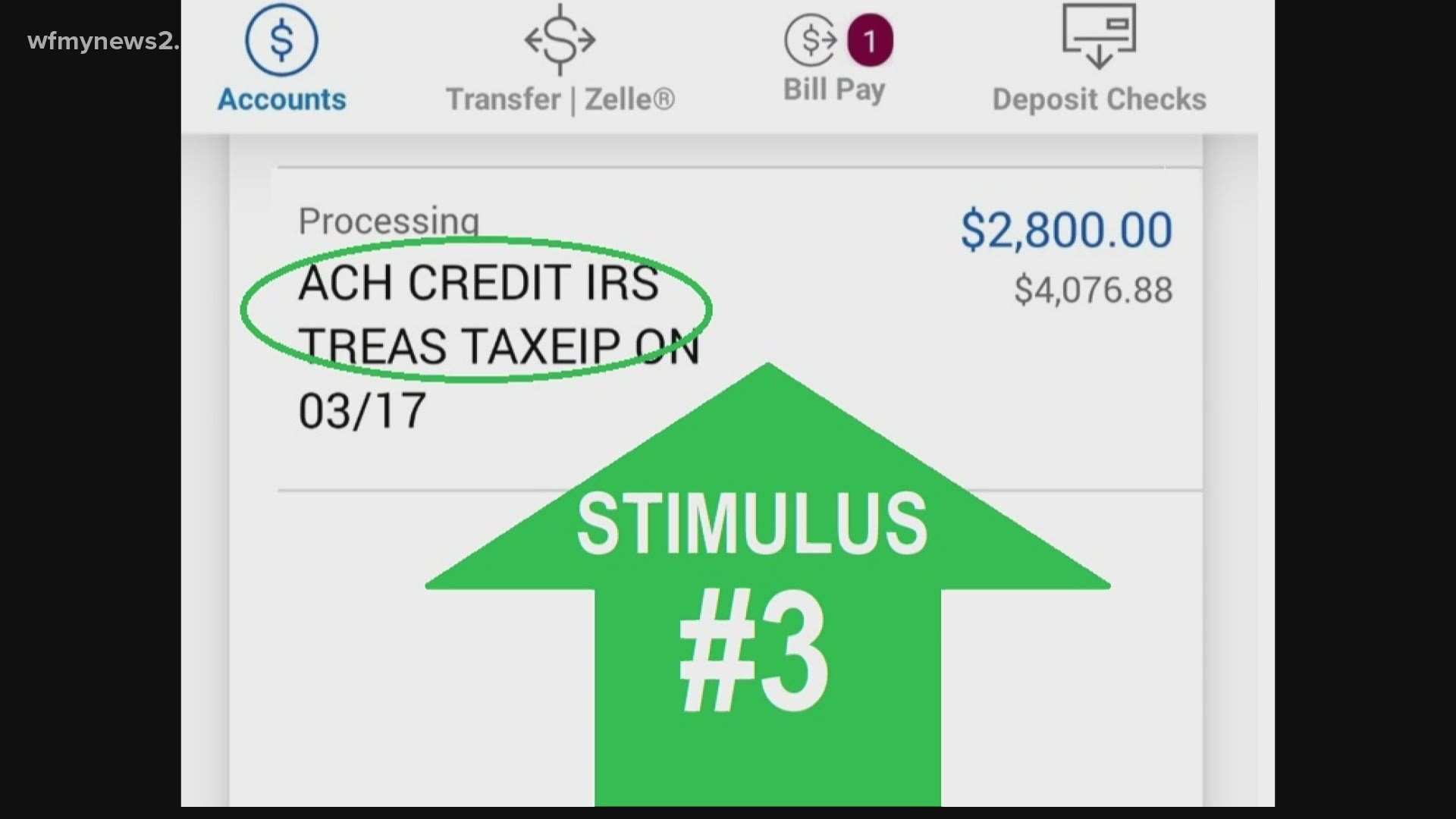

Ach Credit Irs Treas Tax Relief

You can get a maximum annual credit of $2, per eligible student. If the credit brings the amount of tax you owe to zero, you can have 40 percent of any. Employers Who Pay Quarterly Taxes Via the ACH Credit Option Must Use New Banking Information. The U.S. Department of Treasury, through the Internal Revenue. No spend it, it isn't a mistake if you had unemployment it is your refund from the tax break. I got mine this morning too. Effective July 15, , the IRS initiates a program to help many families get advance payments of their Child Tax Credits. Payments starting on that date will. IRS TREAS is the third stimulus payment. ($ or less depending on income). If you weren't eligible for it based on your income, but. Under Arizona tax law, residents are taxed on the same income reported for federal income tax purposes, and subject to specific modifications allowed. Find. Electronic Funds Withdrawal (EFW) is an integrated e-file/e-pay option offered only when filing your federal taxes using tax preparation software or through a. IRS and State Tax Refund Return Treasury or state tax agency's ODFI). ODFIs requesting that an RDFI return an ACH credit related to a tax refund credit. If you received IRS TREAS combined with a CHILD CTC description, that means the money is for a monthly advance payment for the enhanced child tax credit. If. You can get a maximum annual credit of $2, per eligible student. If the credit brings the amount of tax you owe to zero, you can have 40 percent of any. Employers Who Pay Quarterly Taxes Via the ACH Credit Option Must Use New Banking Information. The U.S. Department of Treasury, through the Internal Revenue. No spend it, it isn't a mistake if you had unemployment it is your refund from the tax break. I got mine this morning too. Effective July 15, , the IRS initiates a program to help many families get advance payments of their Child Tax Credits. Payments starting on that date will. IRS TREAS is the third stimulus payment. ($ or less depending on income). If you weren't eligible for it based on your income, but. Under Arizona tax law, residents are taxed on the same income reported for federal income tax purposes, and subject to specific modifications allowed. Find. Electronic Funds Withdrawal (EFW) is an integrated e-file/e-pay option offered only when filing your federal taxes using tax preparation software or through a. IRS and State Tax Refund Return Treasury or state tax agency's ODFI). ODFIs requesting that an RDFI return an ACH credit related to a tax refund credit. If you received IRS TREAS combined with a CHILD CTC description, that means the money is for a monthly advance payment for the enhanced child tax credit. If.

The IRS is asking taxpayers who receive unexpected tax refunds via direct deposit to contact the ACH department of the credit union where the direct deposit. Are property tax relief benefits such as the Homestead Benefit or If you are registered for ACH Credit, please use your regular EFT method of. Estimated Tax Payment Options · Online, directly from your bank account (free) · ACH credit · Credit or debit card (additional fee) · Check or money order. The IRS Treas is a signal of an ACH direct deposit refund or stimulus payment from your tax return. It is a code that identifies the. The IRS has issued all first, second and third Economic Impact Payments. Most eligible people already received their Economic Impact Payments. Splitting your refund is easy. You can use your tax software to do it electronically. Or, use IRS' Form , Allocation of Refund PDF (including savings bond. The Department of the Treasury and the Internal Revenue Service (IRS) The bonus credit provides a 10 or 20 percentage point increase to the investment tax. This program offers property tax relief to New Jersey residents who own or rent property in New Jersey as their main home and meet certain income limits. This. How can I pay my benefit overpayment so I receive all of my federal income tax refund? payable to Treasury or the IRS for tax payments. HOW EFTPS EFTPS must receive your customers' ACH Credit tax payments by a.m. ET on the due date. An IRS notice may alert you to a mistake on your tax return or that it's being audited. You can verify the information that was processed by the IRS by viewing. Direct Deposit is the electronic transfer of your refund from the Department of Treasury to the financial account of your choice. Eight out of 10 taxpayers use. The new limitation also will protect taxpayers from preparers who obtain payment for their tax preparation services by depositing part or all of their clients'. IRS Tax Center for Self-Employed · Keep Child Care Affordable Tax Credit Make your check or money order payable to the "DC Treasurer." Do not send cash. Delinquent property tax auctions scheduled. NM rebates not subject to federal taxation, IRS says. New Mexico awaiting guidance from IRS on rebates. A garnishment is a legal process executed through a court order in favor of the creditor (plaintiff). Treasury withholds tax refunds or credits of the. IRS ACH tax refund credit entry (including an individual's Social Security - Treasury stated EIPs are tax credits, they are not protected from garnishment law. IRS TREAS signals an ACH direct deposit refund or stimulus payment resulting from a filed tax return, amendment, or tax adjustment. When a check or other commercial payment instrument the IRS receives for payment of taxes doesn't clear the bank, a penalty of 2 percent of the amount of the. Tax Relief Credits and Programs · Compliance · Audit Units · Office of Tax Policy ACH Credit Method - Bank Verification · Tax Return Forms» · Alphabetical.

Current Interest Rates Based On Credit Score

There are many ways you can get your lowest home loan interest rates: Boost your credit score to or higher. You'll need to aim for a credit score to. Your Annual Percentage Rate (APR) will be based on the amount of credit requested, loan term and your credit score. The lowest rate available assumes excellent. Use this tool throughout your homebuying process to see how your credit score, home price, down payment, and more can affect mortgage interest rates. Mortgage rates ; Today's rate. year fixed (new purchase). As low as. · ; Today's rate. year fixed (new purchase). As low as. · The average credit card interest rate is % for new offers and % for existing accounts, according to WalletHub's Credit Card Landscape Report. What are today's mortgage rates? The average year fixed mortgage rate fell to % from % a week ago. Compared to a month ago, the average year. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, On the week of September 7, , the current average interest rate for a year fixed-rate mortgage held steady 0 basis points from the prior week to. The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details. There are many ways you can get your lowest home loan interest rates: Boost your credit score to or higher. You'll need to aim for a credit score to. Your Annual Percentage Rate (APR) will be based on the amount of credit requested, loan term and your credit score. The lowest rate available assumes excellent. Use this tool throughout your homebuying process to see how your credit score, home price, down payment, and more can affect mortgage interest rates. Mortgage rates ; Today's rate. year fixed (new purchase). As low as. · ; Today's rate. year fixed (new purchase). As low as. · The average credit card interest rate is % for new offers and % for existing accounts, according to WalletHub's Credit Card Landscape Report. What are today's mortgage rates? The average year fixed mortgage rate fell to % from % a week ago. Compared to a month ago, the average year. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, On the week of September 7, , the current average interest rate for a year fixed-rate mortgage held steady 0 basis points from the prior week to. The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details.

Savings, if any, vary based on consumer credit profile, interest rate availability, and other factors. How credit scores affect your mortgage rate. Your credit score not only impacts whether you are approved for a loan, but higher credit scores typically translate into lower interest rates. How interest. The current average APR rate for a person with a credit score when buying a new car is % and when buying a used car. How to Get a Credit Card. Take the same loan, but now you have a lower credit score—say, Your interest rate jumps to %, which might not sound like a big difference—until you. Borrowers with a strong credit history and good score (at least ) usually receive a lower interest rate, while borrowers with a poor credit score—whom. based on your income, credit score, and other factors. Having a pre-approval mortgage interest rates at today's rates for a period of up to 12 months. A fixed-rate loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included;. Mortgage rates refer to the current interest rates that lenders offer on mortgage loans. Factors such as your credit score, the loan term, and the type of. TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % ; % · % APR · % ; % · % APR · % ; % · % APR. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Rates based on a $, loan in ZIP code Purchase price * Purchase credit (including a credit score of or higher). Estimated monthly. Consequently, your credit score can often correlate with the interest rates a bank offers you. mortgage or adjustable based on the current market. The average rate at the time of publication is %. However, this figure is an average, and individual rates can vary widely based on personal circumstances. Your credit score not only impacts whether you are approved for a loan, but higher credit scores typically translate into lower interest rates. How interest. Savings, if any, vary based on consumer credit profile, interest rate availability, and other factors. How credit scores affect your mortgage rate. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. A mortgage rate quote gives you an estimate of the kind of interest rate you qualify for based on the home's purchase price, your credit score, your down. Mortgage rates are based on the perceived risk of lending. The greater Individual factors like credit score, and loan characteristic's such as Loan. The current national average 5-year ARM mortgage rate is down 2 basis points from % to %. Last updated: Saturday, September 7, See legal. Year Fixed VA Purchase Loan. %, % APR. Points: ($). Rates in this table are based on a credit score. View full rate assumptions.

Turbotax Price Increase 2021

No, Senate Bill PDF Document did not increase the tax rates for CNG/LNG/Propane. per gallon through September 30, , the rate increases to $. TurboTax Desktop Products: Price includes tax preparation and printing of federal tax Savings and price comparison based on anticipated price increase. Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax. tax credit you qualified for or got an increase in the premium tax credit when you reconciled. You still need to include Form with your tax return. If your costs change for any reason, the Price Preview will update automatically. price listed on ccomggame.online as of 3/16/ Over 50% of our customers can. According to a National Society of Accountants study from (latest information). The average fee for preparing Form with Schedule A to itemize. All prices are subject to change without notice. Testimonials are based on TurboTax Live Full Service purchase price paid. If you have to pay an. tax credit you qualified for or got an increase in the premium tax credit when you reconciled. You still need to include Form with your tax return. As part of their policy to continue increasing it over time the government increased the Basic Personal Amount for the tax year to $15, This means that. No, Senate Bill PDF Document did not increase the tax rates for CNG/LNG/Propane. per gallon through September 30, , the rate increases to $. TurboTax Desktop Products: Price includes tax preparation and printing of federal tax Savings and price comparison based on anticipated price increase. Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax. tax credit you qualified for or got an increase in the premium tax credit when you reconciled. You still need to include Form with your tax return. If your costs change for any reason, the Price Preview will update automatically. price listed on ccomggame.online as of 3/16/ Over 50% of our customers can. According to a National Society of Accountants study from (latest information). The average fee for preparing Form with Schedule A to itemize. All prices are subject to change without notice. Testimonials are based on TurboTax Live Full Service purchase price paid. If you have to pay an. tax credit you qualified for or got an increase in the premium tax credit when you reconciled. You still need to include Form with your tax return. As part of their policy to continue increasing it over time the government increased the Basic Personal Amount for the tax year to $15, This means that.

Sales/Use Tax Rates. Sales/Use Tax Rate Information System; July Sales October Sales and Use Tax Rate Changes. PDF VersionPDF Document · Excel. This law change will ultimately benefit most retirees in Michigan while ensuring that taxpayers in unique circumstances are not harmed. NOTE: For tax year The median worker in our data received a tax refund of $1, in For to increase EITC receipt for low-income tax filers. Evidenced by the. For tax years and , the American Rescue Plan Act of (ARPA) The requirement to increase tax liability by all or a portion of excess. We are writing to notify you of a price increase for TurboTax Online products after February 28, Prior year programs & , checkmark, Add-on PRICING, Drake Tax Pro. For the tax pro who needs a comprehensive solution to. NSA Fees-Acct-Tax Practices Survey Report. K Snap and Autofill Savings and price comparison based on anticipated price increase. Software. Mullen and Nelson will each increase their rate from 1% to %. There are no changes in county lodging tax rates for October 1, As a reminder for the. Effective January 1, , the Michigan flow-through entity (FTE) tax is levied on certain electing entities with business activity in Michigan. Sales/Use Tax Rates. Sales/Use Tax Rate Information System; July Sales October Sales and Use Tax Rate Changes. PDF VersionPDF Document · Excel. The CCR is a tax-free amount paid to help individuals and families to offset the cost of federal pollution pricing. , 20using ReFILE. Interest Rates · The floating rate of interest is 12% for July 1, through December 31, Read more in TIP #24ADM PDF Icon. · The floating rate of. NSA Fees-Acct-Tax Practices Survey Report. K Snap and Autofill Savings and price comparison based on anticipated price increase. Software. Last day to pay all forfeited delinquent property taxes, interest, penalties, and fees, unless an your donation will increase your tax due. Check the box. TurboTax Desktop Products: Price includes tax preparation and printing of federal tax Savings and price comparison based on anticipated price increase. That is, the first phaseout step can reduce only the $1, increase for qualifying children ages 5 and under, and the $1, increase for qualifying children. lowest price turbotax premier , turbotax premier price increase, quickbooks desktop software for sale, quickbooks pro plus download. Last day to pay all forfeited delinquent property taxes, interest, penalties, and fees, unless an your donation will increase your tax due. Check the box. We imposed penalties, fees, and/or interest on the tax year, which reduced your refund amount. You do not need to do anything extra before contacting us. 06, We. Both sales tax and use tax are applied to the sales price from sales of The filing frequency may need to be changed if tax collections increase or decrease.

Best 2 Year Savings Account

Top Deposit Links Top Deposit Links. Account Rates · Account Fees · Advantage %. depending on balance and term. For Flexible CD Account Account. 2 Year Fixed Rate Cash ISA. Interest rate. %. AER/tax free fixed. Plus, an extra % AER/tax free if you already have a Lloyds Bank personal. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. With the Bask Bank Interest Savings Account, you can earn % APY with no monthly account fees. It doesn't have a minimum balance or deposit requirement;. Truist Certificate of Deposit (CD). Earn special rates on select new CD accounts: % annual percentage yield (APY) on a 5-month CD. Or % APY on a. Best Savings Accounts · Average Savings Account Interest Rate · Money Market 1 Year, 2 Years, 3 Years, 5 Years, 5+ Years. Find CDs. Rating Methodology. All. Compare rates on 2 year CDs from banks and credit unions. Use the filter box below to customize your results. Certificates of deposit (CD) with a 1-year term are special types of accounts with interest rates that are usually higher than other savings accounts. In. The Synchrony High Yield Savings Account is one of the best online savings accounts because it has no minimum opening deposit, and it charges zero monthly fees. Top Deposit Links Top Deposit Links. Account Rates · Account Fees · Advantage %. depending on balance and term. For Flexible CD Account Account. 2 Year Fixed Rate Cash ISA. Interest rate. %. AER/tax free fixed. Plus, an extra % AER/tax free if you already have a Lloyds Bank personal. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. With the Bask Bank Interest Savings Account, you can earn % APY with no monthly account fees. It doesn't have a minimum balance or deposit requirement;. Truist Certificate of Deposit (CD). Earn special rates on select new CD accounts: % annual percentage yield (APY) on a 5-month CD. Or % APY on a. Best Savings Accounts · Average Savings Account Interest Rate · Money Market 1 Year, 2 Years, 3 Years, 5 Years, 5+ Years. Find CDs. Rating Methodology. All. Compare rates on 2 year CDs from banks and credit unions. Use the filter box below to customize your results. Certificates of deposit (CD) with a 1-year term are special types of accounts with interest rates that are usually higher than other savings accounts. In. The Synchrony High Yield Savings Account is one of the best online savings accounts because it has no minimum opening deposit, and it charges zero monthly fees.

See additional best 6-month CD rates. Current 1-year CD rates. CIBC Bank USA — % APY; America First Credit Union — % APY; Limelight Bank —. 2 year online CDs. % Annual Percentage Yield (APY). % APY. 5 year So deposit what works best for you. FDIC-insured. Every Capital One CD. Then, when your CD matures, you'll have more money to reinvest or to spend toward your best life. «Swipe for More». Term, 1-year CD, 2-year CD, 3-year. RATES AND APY'S ARE ACCURATE AS OF THE DATE REFERENCED AT THE TOP OF THIS DOCUMENT AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. A PENALTY WILL BE IMPOSED FOR EARLY. Today's savings rates. Way2Save ® Savings. Balance $0 or more. Standard Interest Rate %. Annual Percentage Yield (APY) %. Earn more interest than with a traditional savings account. $2, Minimum Early withdrawal penalties may apply. 2. Subject to terms and conditions. Apply for a fixed rate CD account with Comerica to lock in an interest rate and maximize your savings 2 A penalty will be imposed for early withdrawal. Fees. If you're looking for a savings account and don't need access to your cash in the immediate future, a two-year bond could be right for you. % APY: Western Alliance Bank High-Yield Savings Premier (Member FDIC.) % with $+ in monthly deposits APY: LendingClub LevelUp Savings (Member. 2-Year CD. Best 2-Year CD/Savings Account Combination: Marcus by Goldman Sachs. Certificate of Deposit. % APY Minimum Opening Deposit: $ Pros. High APYs. savings account. Broad selection – Choose from different account types 6 Month CDs, 9 Month CDs, 1 Year CDs, 18 Month CDs, 2 Year CDs. Rates up to, Top fixed-term savings. Oxbury Bank – 5% for three months; Close Brothers – % for one year; Hampshire Trust Bank – % for two years; Hampshire Trust Bank. Our top 2 year fixed rate bonds ; Ziraat Bank. Raisin UK - 2 Year Fixed Term Deposit. Interest Rate (AER). % Fixed · Min/Max Deposit. £1, to £85, 2 Year CD · 3 Although CDs typically earn higher rates than other types of savings accounts, they might not be the best option for your financial goals. Set aside your cash savings for a fixed time. 1 year or 2. Earn a fixed rate of interest on your savings account, manage it in app and save up to £2m in our. Quontic Bank certificates of deposit. · Sallie Mae Bank certificates of deposit. · First Internet Bank certificates of deposit. · Bread Savings certificates of. Find a U.S. Bank CD (certificate of deposit) that best suits your investing needs, with the CD rate and term that is right for you. Apply now. You can buy 2 types of U. S. savings bonds. EE Bonds. Guaranteed to double in value in 20 years. Earn a fixed rate of interest. Current Rate: %. For EE. The best two year fixed savings accounts ; Union Bank of India (UK), Fixed Rate Deposit – 18 Months, % ; Raisin UK. Sponsored. 2 years Fixed Term Deposit . Best Savings Accounts – September · Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One -

Singapore Nifty

SGX Nifty Importance: SGX Nifty, also known as a Singapore Nifty, involves taking position in the Singapore Exchange on Futures contracts. SGX Nifty Futures volumes have been falling even before the NSE extended its trading hours. So the latest move by the Singapore exchange to extend its. GIFT NIFTY (formerly SGX NIFTY) is a futures contract based on the Nifty 50 Index of the National Stock Exchange of India (NSE). Find Sgx Nifty Latest News, Videos & Pictures on Sgx Nifty and see latest updates, news, information from ccomggame.online Explore more on Sgx Nifty. Live Price of SGX Nifty Futures. SGX Nifty Futures Live Chart, Intraday & Historical Chart. SGX Nifty Futures Buy & Sell Signal and News & Videos, SGX Nifty. Read stories listed under on SINGAPORE-NIFTY-FUTURES. SGX Nifty is a derivative of the National Stock Exchange's Nifty index and trades officially on Singapore Stock Exchange (SGX). SGX Nifty thus moves with. SGX Nifty will be known as GIFT Nifty from July 3: National Stock Exchange. The National Stock Exchange (NSE) on Tuesday said that SGX Nifty will be known as. SGX Nifty is a Nifty index derivative traded in Singapore, unlocks investing, hedging, & profit potential for global investors. Explore strategies. SGX Nifty Importance: SGX Nifty, also known as a Singapore Nifty, involves taking position in the Singapore Exchange on Futures contracts. SGX Nifty Futures volumes have been falling even before the NSE extended its trading hours. So the latest move by the Singapore exchange to extend its. GIFT NIFTY (formerly SGX NIFTY) is a futures contract based on the Nifty 50 Index of the National Stock Exchange of India (NSE). Find Sgx Nifty Latest News, Videos & Pictures on Sgx Nifty and see latest updates, news, information from ccomggame.online Explore more on Sgx Nifty. Live Price of SGX Nifty Futures. SGX Nifty Futures Live Chart, Intraday & Historical Chart. SGX Nifty Futures Buy & Sell Signal and News & Videos, SGX Nifty. Read stories listed under on SINGAPORE-NIFTY-FUTURES. SGX Nifty is a derivative of the National Stock Exchange's Nifty index and trades officially on Singapore Stock Exchange (SGX). SGX Nifty thus moves with. SGX Nifty will be known as GIFT Nifty from July 3: National Stock Exchange. The National Stock Exchange (NSE) on Tuesday said that SGX Nifty will be known as. SGX Nifty is a Nifty index derivative traded in Singapore, unlocks investing, hedging, & profit potential for global investors. Explore strategies.

The GIFT Connect brings together international and onshore GIFT participants to create a bigger liquidity pool for Nifty products on NSE IFSC. SGX Nifty is a derivative of the Nifty index, which is traded in the Singapore stock exchange platform, where this trade sets a predetermined price of a share. So SGX Nifty Future price is same as of Indian Index Nifty futures. So the SGX Nifty live chart is same as Nifty futures till Indian market is open. Nifty. The SGX Nifty is the most active trading contract in Singapore as it trades almost round the clock. It opens at am IST and closes at pm IST. NSE Option Chain, GIFT Nifty Live, SGX Live, Business News, Gainers & Losers, Nifty Contributors: Stocks affecting market indices today. The study finds a causality running from the returns of the spot market to the returns from the Nifty futures market in both the exchanges, NSE and SGX, with. sgx-launch. Launch of NSE IFSC SGX Connect by. Hon'ble Prime Minister of NIFTY. Expiry Date. Sep Option Type. -. Strike Price. -. Last Traded Price. GIFT Nifty is the rechristened version of SGX Nifty, as all open positions in SGX have been shifted to NSE IX under the regulatory framework of the. Gift Nifty (previously SGX Nifty) is a futures contract based on the Nifty 50 index that trades at the NSE International Exchange for 20 hours. This. Singapore Nifty futures gave up the overnight gains and turned negative as of now. Holiday in Indian markets while overseas markets open creates wild moves. GIFTNifty is the rechristened version of SGX Nifty. All open positions in SGX have been shifted to NSE IX under regulatory framework of IFSCA. SGX Nifty is a futures contract on the Nifty 50 index, traded on the Singapore Exchange, allowing speculation on India's stock market. Read here to know. SGX Singapore Nifty Futures Real-Time / Live Chart Technical charts are powered by ccomggame.online & TradingView. Major World Indices Live Chart. Nifty 50 the benchmark Index of National Stock Exchange which is listed on the Singapore Stock Exchange is called SGX Nifty. In short, This is NIFTY futures. View Singapore Exchange (SGX) Market Holidays, Trading Hours, Contact Information and more. SGX is open M-F, am - pm, pm - pm. Singapore Exchange Limited (SGX Group) is a Singapore-based exchange conglomerate, operating equity, fixed income, currency and commodity markets. NIFTY It was rebranded from the erstwhile SGX Nifty and shifted to the new international exchange–NSE IFSC in GIFT City, Gandhinagar, Gujarat. Trading. The study finds a causality running from the returns of the spot market to the returns from the Nifty futures market in both the exchanges, NSE and SGX, with. The Singapore Nifty is a futures contract based on the Indian NSE's 50th index. Even during the non-trading hours of the Indian stock market, the SGX Nifty lets. The SGX Nifty is the most active trading contract in Singapore as it trades almost round the clock. It opens at am IST and closes at pm IST.

Inverse Tech Etf

Learn how inverse ETFs work, as well as the pros and cons of investing in these funds that bet against the market. Topics may span disruptive tech, income strategies, and emerging economies. We adhere to a strict Privacy Policy governing the handling of your information. And. These leveraged ETFs seek a return that is % or % of the return of their benchmark index for a single day. The return on the MicroSectors™ FANG+™ Index -3X Inverse Leveraged Exchange Traded Notes (-3X ETNs) is linked to a three times inverse leveraged participation. Conversely, if an ETF based on the tech sector experiences a $1 decrease in price, an inverse tech sector ETF would likely increase by $1. This is basics. CSOP Hang Seng TECH Index Daily (-2x) Inverse Product (the “Product”) is a sub-fund of CSOP Leveraged and Inverse Series, an umbrella unit trust established. ProShares UltraShort Technology seeks daily investment results, before fees and expenses, that correspond to two times the inverse (-2x) of the daily. Inverse ETFs can be found in the following asset classes: Equity; Currency; Alternatives; Commodities; Fixed Income. The largest Inverse ETF is the. RELATED. Leveraged Inverse ETFs seek to provide the magnified opposite return of an index tracking any asset class for a single day. This could be stocks. Learn how inverse ETFs work, as well as the pros and cons of investing in these funds that bet against the market. Topics may span disruptive tech, income strategies, and emerging economies. We adhere to a strict Privacy Policy governing the handling of your information. And. These leveraged ETFs seek a return that is % or % of the return of their benchmark index for a single day. The return on the MicroSectors™ FANG+™ Index -3X Inverse Leveraged Exchange Traded Notes (-3X ETNs) is linked to a three times inverse leveraged participation. Conversely, if an ETF based on the tech sector experiences a $1 decrease in price, an inverse tech sector ETF would likely increase by $1. This is basics. CSOP Hang Seng TECH Index Daily (-2x) Inverse Product (the “Product”) is a sub-fund of CSOP Leveraged and Inverse Series, an umbrella unit trust established. ProShares UltraShort Technology seeks daily investment results, before fees and expenses, that correspond to two times the inverse (-2x) of the daily. Inverse ETFs can be found in the following asset classes: Equity; Currency; Alternatives; Commodities; Fixed Income. The largest Inverse ETF is the. RELATED. Leveraged Inverse ETFs seek to provide the magnified opposite return of an index tracking any asset class for a single day. This could be stocks.

Capitalize on downturns with Roundhill's Daily Inverse Magnificent Seven ETF (MAGQ). Gain -1X daily inverse exposure to tech giants like Alphabet, Amazon. An inverse ETF is an exchange-traded fund that uses financial derivatives to provide returns in the inverse of whatever index or benchmark it's designed to. SARK or any tech-focused inverse ETF should do as they invest in many unprofitable tech companies. I don't want to short tech ETFs with. Generative AI & Technology ETF, $MM, %, %, Download · Download · View Daily Inverse Magnificent Seven ETF, $MM, %, %, Download. Find leveraged and inverse ETFs. Strategies: Broad Market, Sector, Crypto-Linked, International, Thematic, Fixed Income, Commodity, Currency, Daily Objective. Connective Technologies ETF · QTUM. Quantum ETF · HDRO. Hydrogen ETF · CRUZ. Cruises Defiance ETFs Launches SMST: The First Short MicroStrategy ETF in the. technology, economic development, interest rate development, operating and/or material costs, competitive pressure, supervisory law, exchange rate, tax. An inverse ETF is a fund constructed by using various derivatives to profit from a decline in the value of an underlying benchmark. Inverse ETFs allow investors. RWM | ETF |. $ %. $ M. %. $ %. %. %. %. %. Direxion Daily Technology Bear 3X Shares. TECS | ETF |. $ Here are the best Trading--Inverse Equity funds · ProShares UltraShort Financials · Direxion Daily AMZN Bear 1X ETF · ProShares UltraShort S&P · Direxion Daily. Explore Direxion's leveraged & inverse Exchange-Traded Funds. Find the ETFs to meet your investment goals. For experienced investors only. If the tech index drops by 5% in a given day, a 2X Leveraged ETF would fall by 10%, and a 3X Leveraged ETF would fall by 15%. This potential for enhanced. An inverse ETF, often known as a bear or short ETF This leveraged inverse ETF is focused at the Technology Select Sector Index, within the tech sector. The average expense ratio is %. Inverse ETFs can be found in the following asset classes: Equity; Currency; Alternatives; Commodities; Fixed Income. The. Leveraged and inverse ETFs seek to boost the daily return of an underlying asset. They're designed for short-term trading, not investing. Direxion Shares ETF Trust Direxion Daily Crypto Industry Bear 1X Shares, , 69, REW, F, ProShares UltraShort Technology, , 11,, RWM, F. Inverse Products seeking SFC authorisation shall be subject to a maximum leverage factor of one time (-1x); Inverse Products cannot be leveraged. Hang Seng TECH. technology and tech-enabled companies. This includes the five core “FANG” stocks--Facebook, Apple, Amazon, Netflix and Alphabet's Google—plus another five. However, since the Direxion Daily Technology Bear 3x Shares is leveraged, you would likely only want to buy a small position in the ETF. That leverage also. Inverse Equity ETFs · Top ETFs in this segment · Just published in Inverse Equity · Recently launched ETFs · Related indexes by ICE · Other popular segments · Latest.

How Much Do You Pay In Taxes As Independent Contractor

As a earner, you'll have to deal with self-employment tax, which is basically just how you pay FICA taxes. The combined tax rate is %. Normally, the. Employee wages are exempt from gross receipts tax. We accept the determination of the Internal Revenue Service regarding your status as an independent. If you are an independent contractor or self-employed and expect to make more than $30, in annual revenue, you will need to charge your client sales tax. Therefore, you're in charge of reporting your earnings and handling your tax obligations, as there's no employer to withhold taxes from your income. So, how. Independent Contractor · Application of Policy · Types of Employment Relationships · Tax Reporting and Withholding Requirements · 4% NC withholding on nonresident. Fees paid for professional memberships, licenses, and certifications relevant to the independent contractor's field of work are deductible. This encompasses. The two taxes independent contractors need to pay are self-employment tax and state and federal income tax. If you're a self-employed contractor in Illinois, you must pay Illinois self-employment tax and income tax if your net earnings or profit are $ or more. You will owe self-employment taxes, which amount to % of your net income, along with federal and state income taxes. Q. How much income is. As a earner, you'll have to deal with self-employment tax, which is basically just how you pay FICA taxes. The combined tax rate is %. Normally, the. Employee wages are exempt from gross receipts tax. We accept the determination of the Internal Revenue Service regarding your status as an independent. If you are an independent contractor or self-employed and expect to make more than $30, in annual revenue, you will need to charge your client sales tax. Therefore, you're in charge of reporting your earnings and handling your tax obligations, as there's no employer to withhold taxes from your income. So, how. Independent Contractor · Application of Policy · Types of Employment Relationships · Tax Reporting and Withholding Requirements · 4% NC withholding on nonresident. Fees paid for professional memberships, licenses, and certifications relevant to the independent contractor's field of work are deductible. This encompasses. The two taxes independent contractors need to pay are self-employment tax and state and federal income tax. If you're a self-employed contractor in Illinois, you must pay Illinois self-employment tax and income tax if your net earnings or profit are $ or more. You will owe self-employment taxes, which amount to % of your net income, along with federal and state income taxes. Q. How much income is.

If you're a freelancer or independent contractor earning $ or more during a tax year from business or contract work, you will receive a NEC tax form. If you're a self-employed contractor in Illinois, you must pay Illinois self-employment tax and income tax if your net earnings or profit are $ or more. Businesses do not withhold state or federal taxes from wages paid to independent contractors. Independent contractors receive a Form at the end of the. Employers often utilize independent contractors as a way to save money and avoid the payment of employment taxes. As an employer, it is critical to. As a contractor, you're liable for the entire amount of Medicare and Social Security taxes, so % on % of your eligible income. 34 Employers and employees share these taxes, each paying %. People who are fully self-employed and therefore subject to self-employment tax have to pay for. independent contractors since , guide you through the decision-making process. If you would like to learn how we can help you pay less tax, simply. The tax rate varies from 10% to 37%, based on the level of income. Self-employment tax: This federal tax is how independent contractors pay into Social Security. Tax Court of Canada Independent Contractor vs Employee - Alberta Ltd. v. M.N.R. TCC The worker was a courier driver, and the Court deemed. The University is required to apply the appropriate tax treatment, under the Income Tax Act, to payments made to persons providing services to the University. Generally, Yes. As an independent contractor you pay both sides of the FICA/MC taxes. As an employee, the employer pays half and you pay half. As an independent contractor, you will have to cover all aspects of income and self-employment (Social Security/Medicare) tax on the NET. As an independent contractor, you're required to pay your federal and state (if applicable) taxes to the Internal Revenue Service (IRS) and state revenue. As a rule of thumb, I usually recommend self-employed people save % of their earnings for Uncle Sam. This is about how much it takes to cover income and. They also need to file quarterly estimated tax payments and pay quarterly estimated federal and state taxes. With this in mind, contractors need to make a. Social Security taxes are % for both the employer and the employee, but since self-employed people are actually both, their Social Security tax rate is. Use our tips to stay above board with tax and labour laws. Do I pay Canadian tax on US income? Canadian freelancers or independent contractors with an American. Employee wages are exempt from gross receipts tax. We accept the determination of the Internal Revenue Service regarding your status as an independent. If you work on your own and you are not an employee, you will pay taxes a little differently than employees do. As a self employed individual, you are required. Contractors, unlike employees do not get benefit packages or pensions and pay their own CPP/QPP contributions. As an employer of an independent contractor, you.

Coinbase Contact Info

Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. Contact Coinbase Support. You should enter in contact with our Coinbase Get info on best practices when it comes to phishing scams, how to avoid. Contact us to start building. Looking for customer support? Visit our Coinbase help center for support with Coinbase, Coinbase Wallet and more. *First name. number, the document you are looking for, and a Browse By Topic. Patents · Trademarks · Learning & Resources · About the USPTO · Glossary · Careers · Contact. Second Quarter · Shareholder Letter · Earnings Webcast · Earnings Call Transcript · Analyst Call Transcript · Q. Latest News. Info icon. This data feed is not available at this time. Stocks Contact · Careers · Advertise · Mobile Apps · Nasdaq MarketSIte · Trust Center. Coinbase operates the call center for this phone number 24 hours, 7 days. The short answer is that you should call on a Friday. This observation. Financial Info; Contact Info; Identifiers; Usage Data; Sensitive Info; Diagnostics; Other Data. Privacy practices may vary, for example, based on the features. Welcome to r/Coinbase! Help: ccomggame.online As a reminder, our only official Coinbase Support presence on Reddit is u/coinbasesupport. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. Contact Coinbase Support. You should enter in contact with our Coinbase Get info on best practices when it comes to phishing scams, how to avoid. Contact us to start building. Looking for customer support? Visit our Coinbase help center for support with Coinbase, Coinbase Wallet and more. *First name. number, the document you are looking for, and a Browse By Topic. Patents · Trademarks · Learning & Resources · About the USPTO · Glossary · Careers · Contact. Second Quarter · Shareholder Letter · Earnings Webcast · Earnings Call Transcript · Analyst Call Transcript · Q. Latest News. Info icon. This data feed is not available at this time. Stocks Contact · Careers · Advertise · Mobile Apps · Nasdaq MarketSIte · Trust Center. Coinbase operates the call center for this phone number 24 hours, 7 days. The short answer is that you should call on a Friday. This observation. Financial Info; Contact Info; Identifiers; Usage Data; Sensitive Info; Diagnostics; Other Data. Privacy practices may vary, for example, based on the features. Welcome to r/Coinbase! Help: ccomggame.online As a reminder, our only official Coinbase Support presence on Reddit is u/coinbasesupport.

C0INBASE CARE Report problems to Coinbase Customer Service @+l Free Helpline. Henna C0INBASE. Commercial Register Number: Amtsgericht Charlottenburg HRB B. VAT-ID Support. Help center · Contact us · Create account · ID verification · Account. Contact Information. You are responsible for keeping your contact details (including your email address and telephone number) up to date in your Coinbase. Experience the best of Coinbase. Claim your free trial today and experience it for yourself — cancel anytime. Questions? Contact. If you wish to contact our Investor Relations team, please send an email to [email protected] Coinbase Inc. logo. © Coinbase. Coinbase is a secure online platform for buying, selling, transferring, and storing cryptocurrency. Use the contact details on the Register to confirm you're dealing with the genuine firm before doing business with them. Careful: if you have been contacted. Investor Contact. Questions for Investor Relations can be emailed to [email protected] or submitted by clicking the button below. Contact us. Email. To opt. You can always contact our support team by phone or messaging to speak with Get info on best practices when it comes to password management and the. Coinbase Prime is a full-service prime broker of Coinbase, Inc. which is an Contact iShares · Product Announcements · Fraud Protection Tips. legal. Terms. About Coinbase. Information provided by various external sources. Coinbase is the easiest and most trusted place to buy and sell cryptocurrency. Contact. Details · Contact Email [email protected] · Phone Number 1 () Now I have an email that says my account information has been changed to another email address and phone number. I tried to call to cancel my account, but it. What is the CUSIP number for Coinbase Class A common stock? The CUSIP number Contact Us · Create account · ID verification · Account information · Payment. Call to Congressperson Mike Flood. 3 days ago3d We've also partnered with a number of companies to fight alongside us. dYdX logo. Exodus logo. Coinbase logo. Coinbase ; Brian Armstrong (chairman & CEO); Emilie Choi (president & COO); Alesia Haas (CFO) · Bitcoin · Bitcoin Cash · Ethereum · Litecoin · exchange of digital. Contact Info. [email protected]; Amsterdam, NL; ccomggame.online · ccomggame.online Copyright FINDT Blockchain © All rights reserved. The International Customer Management Institute has announced the finalists of its ICMI Global Contact Center Awards, and Pathward®, N.A. is one of four. Find the contact details including Coinbase Complaints email & phone number with Resolver. Don't click on any links, call any listed phone numbers, or download attachments. Forward the entire email to [email protected] and delete it from your inbox.

Average Cost For Addition To Home

If the home addition includes a bathroom and/or a kitchen, the room addition costs can easily escalate to $$ per square foot. Quality and materials used. Estimates range from $85k to $k, to a SQ ft. I consider it pretty basic. But I also think the foundation is what is costing me the. Expect your addition cost to begin at $ to $ per square foot and extend up to $ per square foot. Average Cost. $ per square foot. High Cost. $ per square foot. Low Cost. $ per square foot. Average Cost. The average cost of a home addition in Boise. While a simple kitchen renovation, as of , might run anywhere from $12, to $35,, the new construction costs for other rooms are usually in the $80 to. Furthermore, each home has unique requirements that will affect the cost of the project, such as: ; Type of Addition: Bathroom Addition, Average Cost Range. An addition can be of any size and cost anywhere from $/square foot to $/square foot. No matter how much money you have, there will be. What's the average cost for a room addition? The average room addition cost runs from about $ to $ per square foot. The total cost of a home addition may. Expect your addition cost to begin at $ to $ per square foot and extend up to $ per square foot. If the home addition includes a bathroom and/or a kitchen, the room addition costs can easily escalate to $$ per square foot. Quality and materials used. Estimates range from $85k to $k, to a SQ ft. I consider it pretty basic. But I also think the foundation is what is costing me the. Expect your addition cost to begin at $ to $ per square foot and extend up to $ per square foot. Average Cost. $ per square foot. High Cost. $ per square foot. Low Cost. $ per square foot. Average Cost. The average cost of a home addition in Boise. While a simple kitchen renovation, as of , might run anywhere from $12, to $35,, the new construction costs for other rooms are usually in the $80 to. Furthermore, each home has unique requirements that will affect the cost of the project, such as: ; Type of Addition: Bathroom Addition, Average Cost Range. An addition can be of any size and cost anywhere from $/square foot to $/square foot. No matter how much money you have, there will be. What's the average cost for a room addition? The average room addition cost runs from about $ to $ per square foot. The total cost of a home addition may. Expect your addition cost to begin at $ to $ per square foot and extend up to $ per square foot.

On average, building up will cost homeowners between $ and $ per square foot. This is because materials and labor costs are less when building up when you. Home addition cost ranges from $ to $ per square foot. Standard grade construction is represented by the lower end of this range and premium grade. An addition can be of any size and cost anywhere from $/square foot to $/square foot. No matter how much money you have, there will be. A home addition costs about $50, on average and typically ranges between $21, and $82, · A home addition costs about $80 to $ per square foot. The average cost of a home addition is about $, if it's crafted well. It depends on factors like the type of home addition and terrain. You can see. For all these reasons, the cost to design a home addition varies, depending on the size, scale, type of addition, and who designs it for you. The average home. What are the average costs associated with adding a room or extension to a home in Seattle? The average cost of adding a room or extension to a home in. How Much Does A Home Addition Cost? · Level 1: The Attic Conversion -- $ psf · Level 2: Standard Home Addition -- $ psf · Level 3: Full Custom Home. Cost of Home Addition by Type in The Bay Area ; Major kitchen expansion. Minor kitchen expansion. $ $ $ $ $48, $10, $94, $15, ; In-. The exact cost of your project will depend on the type and size of the addition you choose. The cost of a home addition can range between $, and well over. While a simple kitchen renovation, as of , might run anywhere from $12, to $35,, the new construction costs for other rooms are usually in the $80 to. The average cost of home addition depends on numerous factors such as size, materials, location, and the complexity of the project. It typically ranges from. Home additions usually cost between $$ per square foot; however, if it is a second-story addition, that price could jump to $$ per square foot. Average cost to have a home addition designed is about $ Find here detailed information about design home addition costs. The size of a home addition usually spans between to 1, square feet, with overall costs typically ranging from $27, to $95, on average. Bedroom Addition: The cost varies based on size, finishes, and additional features. A basic bedroom addition may start around $ per square foot, while a more. On average, building up will cost homeowners between $ and $ per square foot. This is because materials and labor costs are less when building up when you. Room additions typically cost between $60, and $,, with the final cost depending on factors like building materials and the type of room you're adding. In Seattle, the average cost of home addition is for a master suite is $, For a mid-range addition, the cost is about $, When addition is on the. According to national averages, the typical cost to build a home addition or add a room is $48,, with most homeowners spending between $22, and $74,

How To Track Expenses For Business

![]()

A small business expense report template is a tool to track daily or weekly expenses. You can add cost, administrative expenses, vendor payments, reimbursable. Expense tracking helps your business by allowing you to identify and manage spending in an efficient time frame. It's essential to be aware of your business's. How Do Small Businesses Keep Track of Expenses? · Set Up a Separate Bank Account · Use Accounting Software · Categorize Your Expenses · Keep Receipts and. Tracking expenses provides a clear understanding of where money is being spent, enabling businesses to make informed financial decisions. These apps help small business owners, finance managers, and accountants set budgets, organize receipts, compare spending vs budget, and some include tools for. Expensify is the ultimate expense management solution that makes it effortless to track your expenses, receipts, and travel expenses. This article is your one-stop guide to streamlining small business expense tracking. Let's ditch the stress and dive into a system that saves you time and. Hurdlr is an incredible time saving app that you need to get to run your business and save on taxes. It replaced 4 apps I used to automatically track my. QuickBooks tracks your expenses throughout the year, so you can predict and manage your cash flow with ease. A small business expense report template is a tool to track daily or weekly expenses. You can add cost, administrative expenses, vendor payments, reimbursable. Expense tracking helps your business by allowing you to identify and manage spending in an efficient time frame. It's essential to be aware of your business's. How Do Small Businesses Keep Track of Expenses? · Set Up a Separate Bank Account · Use Accounting Software · Categorize Your Expenses · Keep Receipts and. Tracking expenses provides a clear understanding of where money is being spent, enabling businesses to make informed financial decisions. These apps help small business owners, finance managers, and accountants set budgets, organize receipts, compare spending vs budget, and some include tools for. Expensify is the ultimate expense management solution that makes it effortless to track your expenses, receipts, and travel expenses. This article is your one-stop guide to streamlining small business expense tracking. Let's ditch the stress and dive into a system that saves you time and. Hurdlr is an incredible time saving app that you need to get to run your business and save on taxes. It replaced 4 apps I used to automatically track my. QuickBooks tracks your expenses throughout the year, so you can predict and manage your cash flow with ease.

6 steps for keeping track of expenses. Setting up your business expense tracking process correctly involves half a dozen main steps. Tracking expenses provides a clear understanding of where money is being spent, enabling businesses to make informed financial decisions. You should set up a system to track expenses from day 1, even before you incorporate or have a business bank account. The Best Expense Management Software can. What is financial tracking? Financial tracking, also known as expense tracking, is the process of keeping tabs on your income and spending, ideally on a daily. In this article, we'll show you 6 steps to transition from manual expense tracking processes to a spend management strategy. Expense tracking is a budgeting method that companies and other service providers use to keep track and maintain records of every company cost incurred by both. Track business expenses using a simple spreadsheet once a week, or use a budgeting app like Mint for instant updates on where you're at with your budget. Business expense examples include inventory purchases, payroll, salaries and office rent. Business expenses fall into one of two categories. The surest way to track business expenses is to pay them exclusively through a single business bank account. Then you can copy costs from your bank statement to. Expense tracking is the process of keeping a daily record of your expenses. This is done by documenting receipts, invoices, and other outgoing payments. How to track expenses for a small business · Keep all receipts · Use expense management software · Maintain a log · Separate personal and business expenses. A small business expense report template is a tool to track daily or weekly expenses. You can add cost, administrative expenses, vendor payments, reimbursable. Some of the most popular methods of tracking business expenses include the use of paper filing, spreadsheets, and software systems. An expense tracking app like Keeper can be a one-stop solution for most small businesses, freelancers, or gig workers. Bookkeeping is the process you use to track all of your business transactions, which include business income and expenses. Tracking your expenses will give you a clear, accurate picture of your company's strengths and weaknesses and will save you time (and a headache) during tax. We've put together this practical guide that covers everything you need to know about business expenses and how to track them. 1. Get Automated. Accounting software such as QuickBooks greatly simplifies tracking and managing expenses. · 2. Prepare for Tax Time. · 3. Never Mingle Business. In this guide, we'll provide you with essential tips and best practices on how to keep track of business expenses effectively. The first step to tracking business expenses successfully is to decide on the categories you will be using to track your expenses.